Let’s face it, in today’s digital world, understanding your American Express CVV code is more important than ever. Whether you’re shopping online or booking flights, knowing what this little number does and how it works can save you from potential headaches. So, buckle up, because we’re diving deep into the world of CVV codes, and trust me, you’re gonna want to stick around for this ride.

Now, before we jump into the nitty-gritty details, let me tell you why this topic matters. Your American Express CVV code isn’t just some random set of numbers—it’s a key player in securing your transactions and protecting your financial info. Think of it like your digital bouncer, making sure only the right people get access to your wallet. And let’s be honest, who doesn’t want that?

By the end of this article, you’ll not only know what an American Express CVV code is but also how to use it safely and effectively. So whether you’re a tech-savvy millennial or someone who still writes checks, this guide’s got you covered. Ready? Let’s go!

Table of Contents:

- What is an American Express CVV Code?

- Where to Find Your American Express CVV Code

- Why is the American Express CVV Code Important?

- Security Tips for Your CVV Code

- Common Questions About CVV Codes

- A Brief History of CVV Codes

- Types of CVV Codes

- How to Use Your American Express CVV Code

- Preventing CVV Fraud

- Final Thoughts

What is an American Express CVV Code?

Alright, first things first, let’s break down what exactly an American Express CVV code is. CVV stands for Card Verification Value, and it’s essentially a short numeric code printed on your credit or debit card. For American Express, this code is usually four digits long, unlike the three-digit codes you might see on Visa or Mastercard. It’s like your card’s secret handshake, proving that you actually have the physical card when making purchases online or over the phone.

Why Does It Matter?

Here’s the deal: the CVV code wasn’t created just to annoy you when you’re trying to make a quick purchase. It’s a crucial layer of security that helps merchants verify that you’re the legitimate owner of the card. Without it, anyone could theoretically use your card number to make unauthorized purchases. So yeah, it’s kind of a big deal.

- Rishia Haas Life After Andrew Zimmern Untold Story

- Explore The Isley Brothers Vinyl Greatest Hits More Music

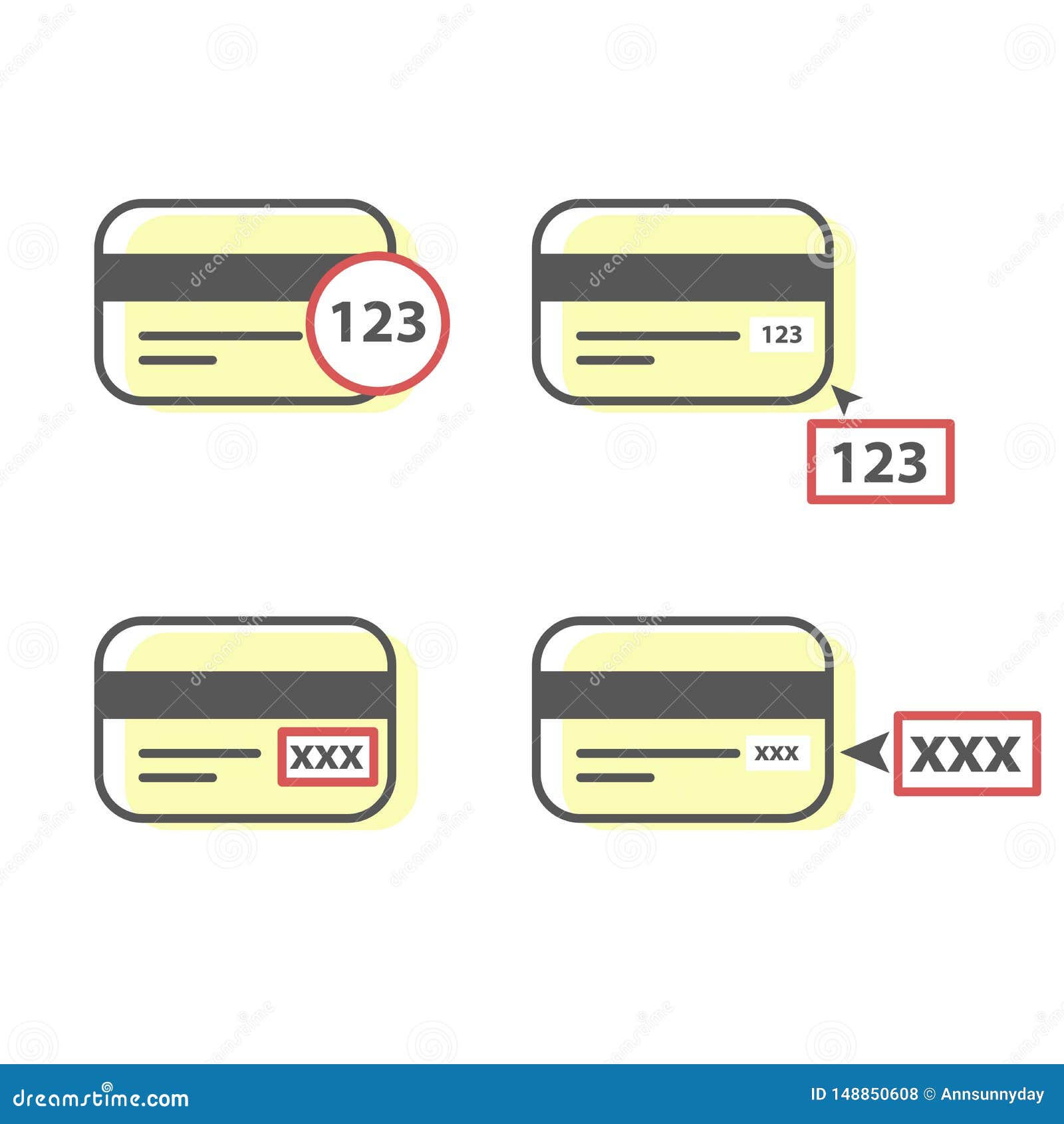

Where to Find Your American Express CVV Code

Now that you know what it is, let’s talk about where to find your American Express CVV code. Spoiler alert: it’s not hiding in some secret location—it’s right there on your card. For American Express cards, the CVV code is usually located on the front of the card, above the card number. It’s that little four-digit number that sometimes gets overlooked.

But wait, there’s more! If you’re using a virtual card or mobile wallet, the process is a bit different. Some digital wallets will display the CVV code when you add your card, while others might require you to generate a virtual CVV for one-time use. Cool, right?

Why is the American Express CVV Code Important?

Let’s be real here—the American Express CVV code is your first line of defense against fraud. When you enter it during an online transaction, it proves to the merchant that you have the actual card in your possession. This is especially important for card-not-present transactions, like shopping online or ordering takeout.

Without a CVV code, transactions would be way more vulnerable to fraud. Imagine someone getting ahold of your card number and going on a shopping spree. Not ideal, right? That’s why the CVV code exists—to keep your financial info safe and secure.

How Does It Work?

Here’s how it works: when you enter your CVV code during a transaction, the merchant sends it to the payment processor to verify its authenticity. If the code matches the one on file with your bank, the transaction is approved. If not, it’s declined. Simple as that.

Security Tips for Your CVV Code

Now that you know why the American Express CVV code is important, let’s talk about how to keep it safe. Here are a few tips to help you protect your financial info:

- Don’t share your CVV code with anyone. Not even your best friend or your dog. Seriously, keep it to yourself.

- Be cautious when shopping online. Only enter your CVV code on secure websites that start with https:// and have a padlock icon in the address bar.

- Monitor your accounts regularly. Keep an eye on your transactions and report any suspicious activity to your bank immediately.

- Use virtual CVV codes when possible. Many mobile wallets offer one-time-use CVV codes for added security.

Following these tips can go a long way in protecting your financial info and preventing fraud. Trust me, you’ll thank yourself later.

Common Questions About CVV Codes

Got questions? Don’t worry, we’ve got answers. Here are some of the most common questions people have about American Express CVV codes:

What Happens If I Lose My CVV Code?

If you lose your American Express card or can’t find the CVV code, don’t panic. Simply call your bank and request a replacement card. They’ll send you a new one with a fresh CVV code in no time.

Can Someone Use My Card Without the CVV Code?

Technically, yes, but it’s much harder. Most merchants require the CVV code for online transactions, so without it, the chances of fraud are significantly reduced. However, it’s always a good idea to keep an eye on your accounts just in case.

A Brief History of CVV Codes

Believe it or not, CVV codes haven’t been around forever. They were first introduced in the early 2000s as a way to combat rising credit card fraud. Before CVV codes, merchants had no way of verifying that the person making the purchase actually had the physical card. This led to a lot of unauthorized transactions and headaches for both consumers and banks.

Enter the CVV code. By requiring this extra layer of verification, merchants were able to significantly reduce fraud and make online shopping safer for everyone. And honestly, we couldn’t be more grateful.

Types of CVV Codes

Not all CVV codes are created equal. Depending on your card issuer, you might see different variations of the code. Here’s a quick breakdown:

- CVV1: This is an older version of the CVV code that was used primarily for magnetic stripe transactions. It’s no longer in use today.

- CVV2: This is the version you’re probably most familiar with. It’s the three- or four-digit code printed on the back (or front) of your card.

- Dynamic CVV: Some newer cards come with a dynamic CVV code that changes every hour or so. This adds an extra layer of security by making it harder for fraudsters to use stolen card info.

So yeah, there’s more than one type of CVV code out there, but for most people, the CVV2 is the one you’ll be dealing with.

How to Use Your American Express CVV Code

Using your American Express CVV code is pretty straightforward. Here’s a step-by-step guide:

- Locate your CVV code on your card. For American Express, it’s the four-digit number on the front.

- When prompted during an online or phone transaction, enter the CVV code in the designated field.

- Double-check that you’ve entered the correct number before submitting your transaction.

- That’s it! Your transaction will be verified, and you’ll be good to go.

It’s really that simple. Just remember to keep your CVV code safe and never share it with anyone.

Preventing CVV Fraud

Fraud is a scary word, but the good news is there are steps you can take to prevent it. Here are a few tips:

- Enable transaction alerts. Most banks offer text or email alerts for every transaction made on your card. This way, you’ll know immediately if something suspicious is happening.

- Use two-factor authentication. If your bank offers it, enable two-factor authentication for added security.

- Monitor your accounts regularly. Regularly check your transactions for any unauthorized activity.

- Report suspicious activity immediately. If you notice anything fishy, call your bank right away.

By taking these precautions, you can significantly reduce your risk of falling victim to CVV fraud. And let’s be honest, who doesn’t want that peace of mind?

Final Thoughts

Alright, we’ve covered a lot of ground here, but let’s recap the key takeaways. Your American Express CVV code is a crucial part of keeping your financial info safe and secure. By understanding what it is, where to find it, and how to use it safely, you can protect yourself from potential fraud and enjoy the convenience of online shopping without worry.

So go forth and shop with confidence, knowing that your CVV code has got your back. And if you have any questions or comments, feel free to drop them below. We’d love to hear from you! Oh, and don’t forget to share this article with your friends—knowledge is power, after all.

Thanks for reading, and stay safe out there!

Detail Author:

- Name : Oda Willms I

- Username : ukshlerin

- Email : kamryn.cruickshank@hotmail.com

- Birthdate : 1990-12-24

- Address : 310 Bailey Turnpike Apt. 844 South Abagail, VA 25571

- Phone : (727) 426-1102

- Company : Kling-Marquardt

- Job : Locomotive Engineer

- Bio : Quia aut eum veniam maxime eos quos temporibus. Aut consequuntur atque corporis doloremque et doloribus. Ut labore nisi ducimus quos.

Socials

linkedin:

- url : https://linkedin.com/in/keithwest

- username : keithwest

- bio : Aut minus qui aperiam est facere non.

- followers : 6965

- following : 2812

tiktok:

- url : https://tiktok.com/@west1973

- username : west1973

- bio : Dolores tempore ut beatae tempore amet.

- followers : 3663

- following : 2605

facebook:

- url : https://facebook.com/west2015

- username : west2015

- bio : Quis mollitia sit itaque iure tempore.

- followers : 4293

- following : 2708

instagram:

- url : https://instagram.com/keith_west

- username : keith_west

- bio : Non est beatae architecto maxime facere eum. Libero cum reprehenderit itaque nesciunt et nihil.

- followers : 4402

- following : 2386