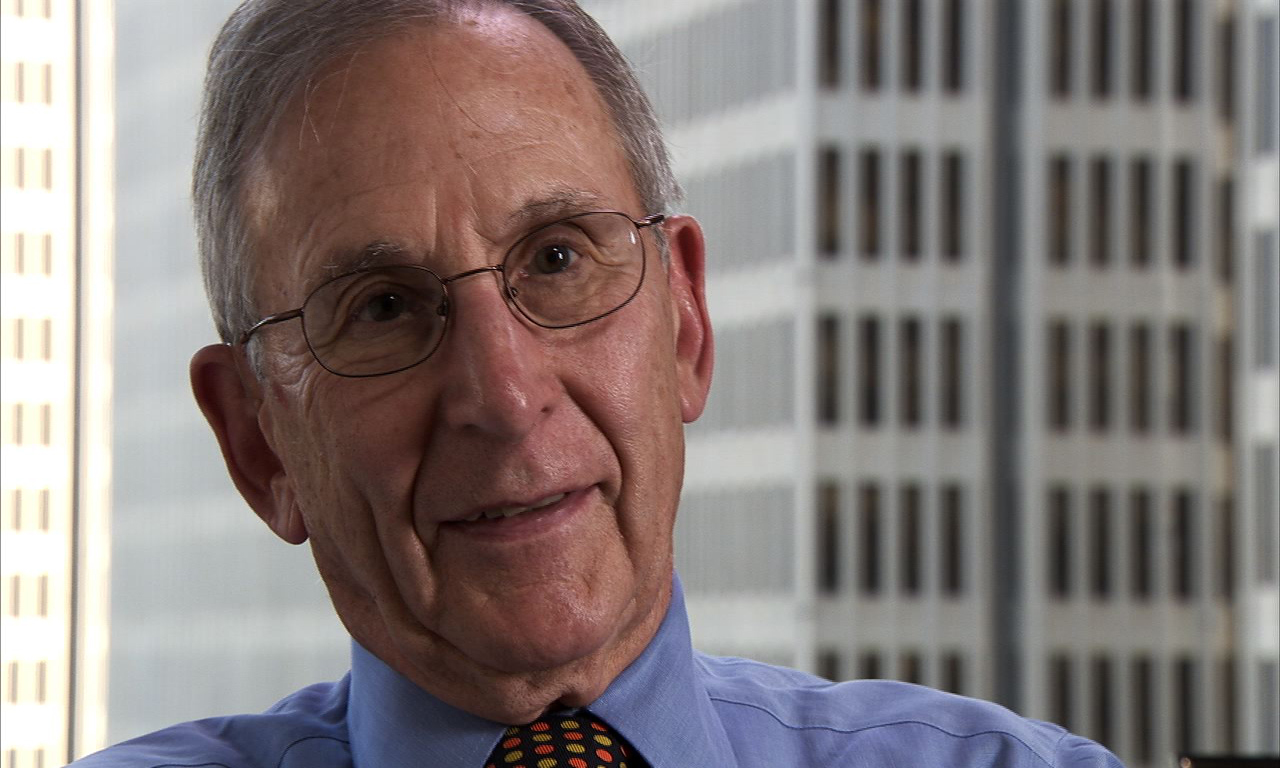

Ever wondered who the silent architect behind some of the world's most groundbreaking tech companies was? Arthur Rock isn't just a name; it's a legacy etched in the very foundations of Silicon Valley.

Born on August 19, 1926, in Rochester, New York, Arthur Rocks journey from a candy store assistant to a legendary venture capitalist is a testament to his sharp intellect, unwavering principles, and an uncanny ability to spot potential. He was not just an investor; he was a guiding force, a mentor, and a pivotal figure in shaping the modern technological landscape. His early bets on companies like Intel, Apple, Scientific Data Systems, and Teledyne weren't mere financial transactions; they were strategic partnerships that propelled these firms to unprecedented heights. Based in the vibrant hub of Silicon Valley, California, Rock's influence extends far beyond the balance sheets; it permeates the ethos of innovation and entrepreneurship that defines the region.

| Full Name | Arthur Rock |

| Date of Birth | August 19, 1926 |

| Place of Birth | Rochester, New York, USA |

| Nationality | American |

| Education | Harvard Business School (MBA, 1951) |

| Occupation | Venture Capitalist, Businessman, Investor, Philanthropist |

| Career Highlights |

|

| Philanthropic Activities |

|

| Awards and Honors |

|

| Spouse | Toni Rembe Rock |

| Reference Link | Arthur Rock Center for Entrepreneurship at Harvard Business School |

Arthur Rocks approach to venture capital was revolutionary. He didn't just look at the numbers; he assessed the character and vision of the founders. He sought individuals with unwavering integrity, a clear mindset, and a compelling vision for the future. This emphasis on qualitative factors set him apart from many of today's VC practices, which often rely heavily on data-driven analysis and market trends. His success stemmed from his ability to identify and nurture exceptional talent, providing not only capital but also invaluable guidance and support.

- Loni Anderson Now Then Now See The Wkrp Star Today

- Yuko Kubota Life With Josh Blue What Happened After

Rocks influence resonates through the corridors of academia as well. He established the Arthur Rock Center for Entrepreneurship at Harvard Business School, a testament to his commitment to fostering the next generation of innovators. The center serves as a hub for aspiring and experienced entrepreneurs, offering a comprehensive range of programs, faculty expertise, and a robust alumni network. Furthering his dedication to education and ethical business practices, he and his wife, Toni Rembe Rock, founded the Arthur & Toni Rembe Rock Center for Corporate Governance at Stanford University. These institutions stand as enduring symbols of his belief in the power of education and the importance of responsible corporate leadership.

His contributions have not gone unnoticed. Arthur Rock is the recipient of numerous accolades, including the 1987 EY Entrepreneur of the Year Award and the 1989 Golden Plate Award of the American Academy of Achievement. These honors recognize his outstanding achievements in the world of business and his profound impact on American society.

Delving into his early career, we find Rock honing his skills as a securities analyst in New York City in 1951. He later joined the corporate finance department of Hayden, Stone & Company, where he focused on raising capital for small, high-tech businesses. This experience provided him with a crucial understanding of the challenges and opportunities faced by emerging technology companies, laying the groundwork for his future success as a venture capitalist.

- Heather Rae Young Unveiling The Secrets Behind Her Net Worth

- Who Are Marley Sheltons Siblings Family Life Revealed

His decision to relocate to Silicon Valley in 1961 marked a turning point in his career and in the history of venture capital. Recognizing the immense potential of the burgeoning tech industry in the San Francisco Bay Area, Rock established his own investment company and began to play a pivotal role in shaping the region into the global center of innovation it is today.

Arthur Rock was more than just a financier; he was a catalyst for innovation. He understood that the key to success lay not only in providing capital but also in fostering a supportive ecosystem for entrepreneurs. He actively mentored founders, providing them with strategic advice, access to networks, and the encouragement they needed to overcome obstacles and achieve their full potential.

He was instrumental in the formation of Fairchild Semiconductor, a company that is widely credited with sparking the semiconductor revolution. His ability to recognize the potential of the "traitorous eight," a group of talented engineers who left Shockley Semiconductor Laboratory to form Fairchild, demonstrated his keen eye for talent and his willingness to take calculated risks.

Rock's investment in Intel, co-founded by Robert Noyce and Gordon Moore, further solidified his reputation as a visionary investor. He recognized the potential of Intel's innovative approach to semiconductor manufacturing and provided the company with the financial backing and strategic guidance it needed to become a global leader. His involvement with Apple Computer, Inc. in its early days is another testament to his ability to identify and nurture companies with the potential to transform industries. He saw in Steve Jobs and Steve Wozniak the spark of genius that would revolutionize personal computing.

Beyond his investments in individual companies, Arthur Rock played a broader role in the development of Silicon Valley. He helped to create a culture of innovation and entrepreneurship that attracted talent and capital from around the world. His success inspired countless others to pursue their dreams and build their own companies, contributing to the region's remarkable economic growth and technological advancement.

The Arthur Rock Center for Entrepreneurship at Harvard Business School stands as a living legacy to his vision and commitment. The center offers a wide range of programs, including courses, workshops, and competitions, designed to equip students with the skills and knowledge they need to succeed in the world of entrepreneurship. It also provides access to a vast network of alumni and industry experts, creating a supportive community for aspiring founders.

The Rock Foundation, established in the late 1960s by Arthur Rock and his wife Toni Rembe Rock, is another expression of their philanthropic commitment. The foundation provides grants to organizations working in the areas of education, legal rights, arts and culture, and the San Francisco community. Through their foundation, the Rocks have made a significant impact on a wide range of important social causes.

Arthur Rock's career is a masterclass in venture capital. His success stemmed not only from his financial acumen but also from his deep understanding of human nature and his unwavering commitment to ethical principles. He believed that the best investments are those that create value for society as a whole, not just for shareholders.

His legacy continues to inspire entrepreneurs and investors around the world. He demonstrated that success in business can be achieved without compromising one's integrity or losing sight of the importance of giving back to the community. Arthur Rock's life is a testament to the power of vision, hard work, and a deep commitment to making a positive impact on the world.

Rock commenced his career in 1951 as a securities analyst in New York before joining the corporate finance department of Hayden, Stone & Company, where he concentrated on raising funds for small, high-tech enterprises. This early experience honed his skills in identifying promising ventures and laid the groundwork for his future endeavors.

Following his tenure at Hayden, Stone & Company, Rock ventured into the realm of venture capital, partnering with Tommy Davis to establish Davis & Rock in 1961. This marked a pivotal moment in his career as he transitioned from advising companies to actively investing in and shaping their growth trajectories. Davis & Rock quickly gained recognition for its forward-thinking investment strategies and its commitment to supporting innovative startups.

In the ensuing years, Rock further solidified his position as a leading figure in the venture capital industry by founding Arthur Rock & Co. This venture capital firm served as a vehicle for his continued investments in groundbreaking technology companies, allowing him to leverage his expertise and network to identify and nurture promising startups with transformative potential.

Throughout his illustrious career, Rock maintained an active involvement in various corporate boards and organizations. He served on the board of directors of Echelon Corporation, contributing his insights and guidance to the company's strategic direction. Additionally, he held a position on the board of the National Association of Securities Dealers (NASD), where he played a role in shaping industry standards and regulations.

Beyond his direct involvement in venture capital and corporate governance, Rock also served as president of the Basic Fund, an organization dedicated to providing financial support to deserving causes and initiatives. Through his leadership of the Basic Fund, Rock demonstrated his commitment to philanthropy and his desire to make a positive impact on society.

The establishment of the Rock Center at Harvard Business School stands as a testament to Rock's enduring legacy in the field of entrepreneurship. Named in his honor, the center serves as a hub for aspiring entrepreneurs, providing them with resources, mentorship, and educational opportunities to hone their skills and launch successful ventures. Rock's generous contribution to the center has enabled countless students to pursue their entrepreneurial dreams and contribute to the advancement of innovation.

Arthur Rock's influence extends far beyond the confines of Silicon Valley. His pioneering spirit, his unwavering commitment to ethical principles, and his profound understanding of the human element in business have left an indelible mark on the world of technology and finance. His legacy serves as an inspiration to aspiring entrepreneurs and investors, reminding them that success can be achieved through vision, integrity, and a dedication to making a positive impact on society.

In June, members of the HBS community gathered to express their gratitude to Arthur Rock (MBA 51) for his generous $25 million donation and to dedicate the Arthur Rock Center for Entrepreneurship. This event underscored the profound impact of Rock's philanthropy on the school and its commitment to fostering entrepreneurial talent.

Furthermore, information and profiles related to Arthur Rock are continuously updated on platforms like nguoinoitieng.tv, providing a comprehensive and up-to-date resource for those seeking to learn more about his life and career. While such sources offer valuable insights, it's essential to verify the accuracy of information and consider it as a reference point in conjunction with other reputable sources.

While some information about Arthur Rock may be incomplete or potentially inaccurate, it's crucial to consult multiple sources and critically evaluate the available data. This approach ensures a well-rounded understanding of his contributions and accomplishments, allowing for a more informed perspective on his impact on the world of venture capital and entrepreneurship.

Tras esta operacin, Arthur Rock lleg a la conclusin que todas las grandes empresas y operaciones relacionadas con el mundo de la tecnologa tenan lugar en el rea de la baha de San Francisco, es decir, en el Silicon Valley; As que decidi trasladarse all en 1961 y fundar su propia compaa de inversiones.

Rock commence sa carrire en 1951 en tant qu'analyste de valeurs mobilires New York, puis rejoint le dpartement de financement d'entreprise de Hayden, Stone & Company New York, o il se concentre sur la collecte de fonds pour de petites entreprises de haute technologie.

The Rock Center serves as the central hub for entrepreneurship at Harvard Business School (HBS). It serves as a launchpad for HBS students who are founders, joiners, or investors, enabling them to bring their ideas to life and develop ventures that drive global impact.

Detail Author:

- Name : Nikko Lind

- Username : streich.nicolette

- Email : dawn81@yahoo.com

- Birthdate : 1997-08-16

- Address : 583 Deckow Isle East Gwendolynhaven, OH 37313-4543

- Phone : 754-257-1591

- Company : Gutmann, Ratke and Walsh

- Job : Camera Operator

- Bio : Laboriosam quidem ut ut voluptas qui. Facilis enim dignissimos ut. Aut cupiditate nostrum sit vitae aperiam quo.

Socials

instagram:

- url : https://instagram.com/alannamoen

- username : alannamoen

- bio : Modi nisi aut commodi sapiente occaecati. Deleniti impedit voluptatum eius enim.

- followers : 1555

- following : 1843

linkedin:

- url : https://linkedin.com/in/amoen

- username : amoen

- bio : Dolor eius totam fugit omnis.

- followers : 3865

- following : 2789

tiktok:

- url : https://tiktok.com/@amoen

- username : amoen

- bio : Est in vitae adipisci possimus consequatur.

- followers : 5430

- following : 543